Discover more from HEALTH CARE un-covered

She was the first American woman to win the all-around gold medal in Olympic gymnastics. Now she's buried in medical debt.

Meanwhile, UnitedHealth is making billions in profits.

This is America.

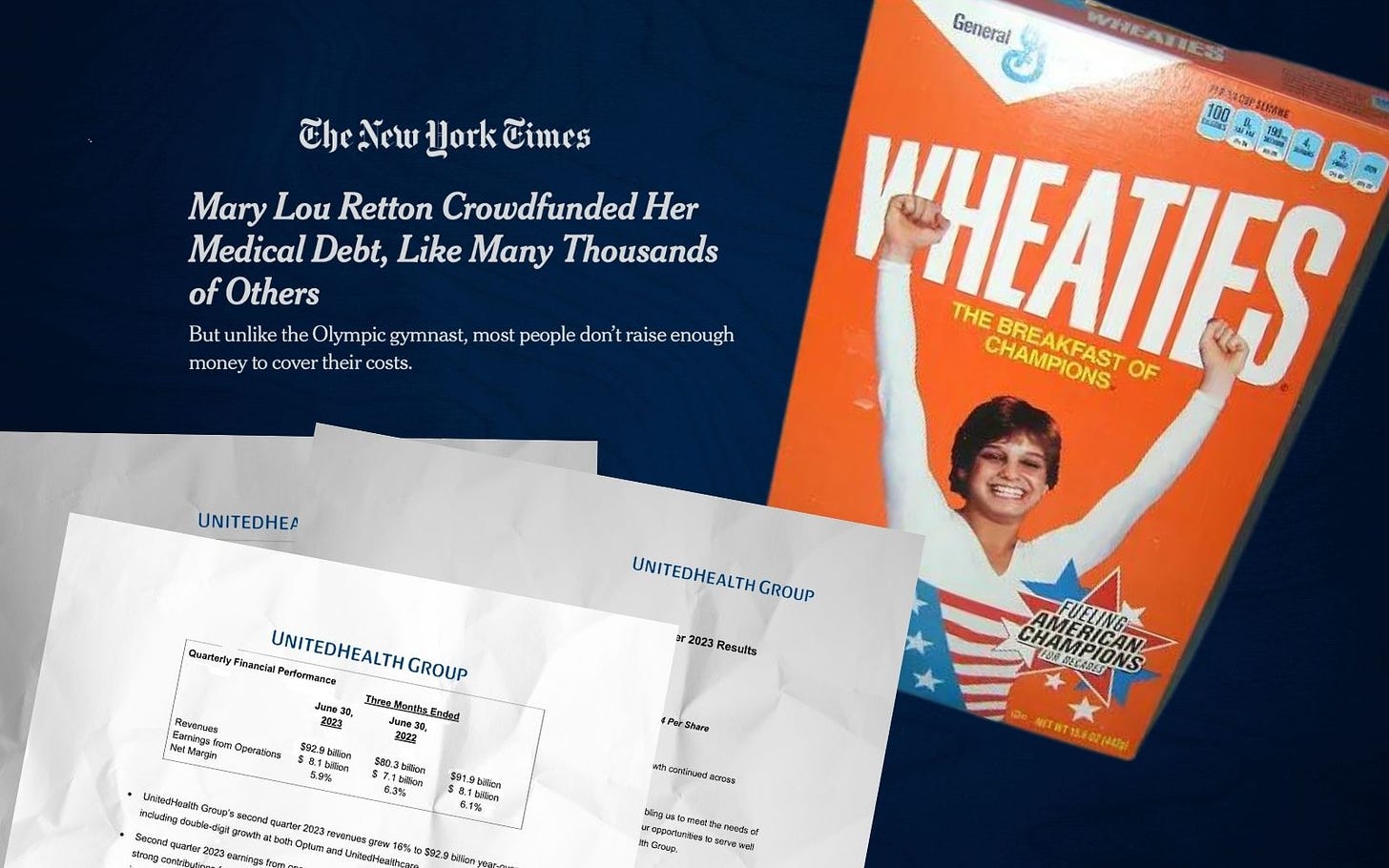

The New York Times reported on Thursday that Olympic gold medalist Mary Lou Retton, one of the most famous and admired people in the world in the 1980s, is so deep in debt from medical expenses that her family launched a crowdfunding campaign to pay off her debt.

Meanwhile, on Friday morning, UnitedHealth Group, the nation’s biggest insurer, said it made $8.5 billion in profits between the first of July and the end of September on revenues that totaled $56.7 billion. All that in just three months.

As the Times’ Sarah Kliff noted in her story about Retton, about half of Americans have difficulty paying their medical bills, and a quarter of a million of us resort to publicly begging for help on GoFundMe and similar platforms. Many, like Retton, are uninsured, but, increasingly, people who pay premiums to companies like UnitedHealth are going broke because their policies are so inadequate. That’s why I started the Lower Out-of-Pockets NOW Coalition, which demands that lawmakers and employers eliminate or at least greatly reduce the growing burden of deductibles, copays and coinsurance obligations most insured Americans now face.

While Retton is fighting for her life and asking strangers to help pay her hospital bill, UnitedHealth, which reported $25 billion in profits during the first nine months of 2023, said on Friday it expects to make even more money this year than it previously thought possible. Instead of using some of its fortune to lower premiums and reduce out-of-pocket expenses, it spent $11.5 billion during the last nine months rewarding its shareholders–89% of which are large institutional investors–through dividends and share buybacks. Most of that will benefit just 17 investors who own half the company’s stock.

One way UnitedHealth and other insurers make so much money is by forcing people enrolled in their health plans to pay hundreds–and, in many cases, thousands–of dollars out of their own pockets before their coverage will kick in. Increasingly, people begging for money on GoFundMe and other crowdfunding platforms have health insurance. (When you have a few free hours, go to GoFundMe and search for “health insurance deductible” for a glimpse into what’s happening in this country, thanks to the business practices of companies like UnitedHealth.)

Ripping off taxpayers to maximize profits

Despite this nightmare that has become a reality for so many of us, UnitedHealth’s revenues, profits and share price continue to soar as it keeps picking your pockets, even if you are not one of of the company’s customers.

Not only does UnitedHealth make money for investors by shifting more and more of the cost of care onto the shoulders of its health plan enrollees, it is also making massive profits from the so-called Medicare Advantage program, which is funded by taxpayers, seniors and the disabled. Although UnitedHealth has three and a half times more people enrolled in its commercial plans (27.3 million) than in its Medicare Advantage plans, which it co-brands with AARP (7.6 million), it now makes far more money per person on the public programs (Medicare and Medicaid) our government has largely turned over to private insurers. As a consequence of the federal government’s overly generous payments and lack of adequate oversight, UnitedHealth now gets 35% of its total health plan revenues from its Medicare business. (Another 20% comes from the Medicaid programs it operates for several states.)

While our lawmakers, Democrats and Republicans alike, have largely looked the other way, UnitedHealth and a handful of other big, for-profit corporations have carved out a category all their own when it comes to ill-gotten gains, and they’re spending billions to keep the gravy train going. (Overpayments to insurers now total up to $140 billion a year, according to a new report by Physicians for a National Health Program). That’s why you are once again seeing so many TV commercials designed to lure as many seniors as possible into insurers lucrative Medicare Advantage plans.

Researchers at KFF (previously Kaiser Family Foundation) and Wesleyan University looked at Medicare Advantage advertising last year and found 643,852 airings of English-language Medicare ads that ran on broadcast television and national cable between October 1, 2022, and December 7, 2022. That’s an average of more than 9,500 airings per day. Incredibly, the government doesn’t require insurers to disclose in those ads the many disadvantages of Medicare Advantage, like often inadequate networks of doctors and hospitals and, as the Office of Inspector General found last year, excessive use of “prior authorization” to deny and delay medically necessary care.

That–and the fact that insurers spent tens of millions more on deceptive ads targeting Congress and the White House earlier this year to protest a pay raise they thought was too meager–tells you all you need to know about how lucrative Medicare Advantage is to big corporations like UnitedHealth. They’re spending your tax dollars lavishly to entice more and more seniors into their private Medicare plans so they can grab even more of your tax dollars. (Medicare “open enrollment” started yesterday and runs through December 7, so expect to see deceptive wall-to-wall Medicare Advantage ads whenever you turn on your TV.)

Retton is the new face of an American disgrace

Retton, who is 55, is a decade away from being eligible for Medicare and, thankfully, appears to be improving after more than a week in intensive care from a rare form of pneumonia. Sadly, despite her Olympic medals and fame–she was featured on the 1984 Wheaties box after winning the All-Around gold medal at the Los Angeles Olympics–she has landed among the 27.5 million other Americans who don’t have health insurance, primarily because of the cost.

Let’s pause here to let that sink in. While 27.5 million is a huge–and growing–number, we’ve become inured to that and other data that paint such a grim picture of our health care system. But please know this: that 27.5 million encompasses people you know, people you likely are related to, and maybe even you and your family. For the most part, they are people who work hard in often low-paying jobs to make our lives better in one way or another–or people who have lost their jobs and, along with them, their health insurance.

Skyrocketing premiums, out-of-pocket requirements–and insurer stock prices

In another research project, KFF found that annual premiums for employer-sponsored family health coverage reached an average of $22,463 last year, with workers on average paying $6,106 toward the cost of their coverage. As premiums have soared, many businesses have stopped offering coverage, and many employees of companies that still offer it are taking a pass because they can’t afford their share of the costs.

And increasingly, Americans who do have insurance can’t afford to use it, even as they pay more in premiums every year. That’s because families with private insurance can be on the hook for nearly $20,000 in out-of-pocket expenses before their insurers will pay a dime.

While Retton’s family is begging for money, UnitedHealth’s stock price closed at $539.40 on Friday, up $13.86 per share. The company’s share price has increased 20-fold since March 23, 2010, when former President Obama signed the Affordable Care Act into law. At the bill signing, then-Vice President Joe Biden was famously overheard calling it a “big f*cking deal.”

For UnitedHealth, it certainly was. In 2010 it ranked 21st on the Fortune 500 of American companies. Today it is number five. Last year, it paid its CEO, Sir Andrew Witty, $23.8 million.

It’s long past time for Congress and President Biden to pay attention to how insurers are taking all of us to the cleaners and do something about it. Not only are Mary Lou Retton and millions of other Americans uninsured and at risk of going bankrupt, losing their homes and dying early, so are millions of families with insurance–all while executives like Sir Andrew Witty and a few investors get richer and richer.

Subscribe to HEALTH CARE un-covered

Pulling back the curtains on how Big Health is hurting Americans and how we got to this point.

Let’s hope once she recovers I hear she is improving she advocates for all. Also why aren’t our politicians advocating for affordable, safe, quality of care. Also of concern in Medicare Advantage ripping people off. Great article

Pass the hot potato

Providers are denying care under ' We don't know what/which your primary coverage is.' Medicare says 'We can only go by the record we have. Shows you have other coverage.' In the meantime, while you get bounced back and forth you can't get the appointment without giving the provider confirmed coverage. Medicare says you can't be turned down for care because of insurance coverage or lack of, but providers work around this by coming up with reasons to NOT make the appointment. Is this what Medicare has become? Recovery tactics before the care is provided?