Retirees in Cortland County, New York, opposed UnitedHealth's Medicare grab and won. At least, for now.

We’ve been publishing numerous stories about how health insurers are refusing to pay for medically necessary care in both the private health plans they operate under the so-called Medicare Advantage name and in the health plans Americans buy on their own or through their employers.

Our reporting and advocacy is having an impact, in Washington and across the country. Members of Congress on both sides of the aisle and the Biden Administration are beginning to scrutinize and crack down on the business practices of Medicare Advantage insurers. And there is growing evidence that employers, including county and municipal governments that planned to force their retirees into Medicare Advantage plans–like Cortland County, New York–are having second thoughts. Those employers are learning that they may have been sold a bill of goods–and misled and outright lied to–by insurers that make huge profits from their Medicare Advantage business.

Thanks to a recent report from ProPublica and Scripps News, we are learning more about how insurers cheat patients out of life-saving care by ignoring state laws that mandate coverage for many life-threatening conditions (which I told members of Congress about way back in 2009.) Under oath, I testified that “Insurers make promises they have no intention of keeping, they flout regulations designed to protect consumers, and they make it nearly impossible to understand — or even to obtain — information we need.”

Unfortunately, insurers continue to make essential information nearly impossible to find. They go to great lengths to obscure it — if they’re willing to provide it at all.

A few weeks ago, I was asked to submit an affidavit on behalf of plaintiffs in a lawsuit against Cortland County, which had been planning to steer retired county employees into a Medicare Advantage plan operated by UnitedHealthcare. Just this week, county officials said they were ditching those plans, at least for the coming year.

At the heart of this and similar lawsuits across the country — including one in New York City, which I’ve written about — is a prevalent industry practice called “prior authorization.” Almost all insurers maintain a long list of procedures, tests and medications that the insurers insist must be approved in advance before they will pay a dime.

As this practice has come under Congressional and media scrutiny, some insurers — including UnitedHealthcare and Cigna, where I worked — have sent out press releases in recent months saying they have voluntarily eliminated the prior authorization requirement for some procedures. As the former VP of corporate communications at Cigna, I can assure you that they did that to try to take the heat off of them and to make people think Congress should just back off, that the industry can police itself. Do not believe those press releases.

Do you have any idea which procedures your insurers say must have approval in advance? And how often insurers refuse to approve doctors’ requests for coverage of something they know you need? I doubt you do, because the information is — by design — almost impossible to find.

I discovered recent evidence of that as I was doing research for my affidavit. I came across a document a Cortland County official sent to the county’s retirees to assuage their concerns about the country’s plan to move them into UnitedHealthcare’s Medicare Advantage plan. It was in the form of a Q&A entitled “Common Questions Regarding the United Health Care (sic) Medicare Advantage PPO plan. This is question 11:

Q: It appears that with this plan, retirees may need to get preauthorization for some services. What are some examples of preauthorization that will now be required that are not with the current plan? (Editor’s note: Unlike Medicare Advantage plans, traditional Medicare rarely uses prior authorization.)

A: UnitedHealthcare is unable to provide a document which shows all the procedures which will require prior authorization. It is important to point out that providers that are in-network are already familiar with the requirements around prior authorizations and what documentation is required when requesting prior authorization. Out-of-network providers are not required to submit prior authorization for services. The majority of prior authorizations are approved automatically at the time they are submitted.

I do not know if this was a deliberate attempt by the county to hide information from the retirees or if they simply didn’t press UnitedHealthcare hard enough. But they had access to documents that provided that information. Admittedly, they would have had to do a little searching because it was not all that easy to find.

Here’s what I wrote in my affidavit:

It is also important to understand that Medicare Advantage enrollees find it difficult to determine which procedures and medications are subject to prior authorization requirements. Indeed, the Cortland County personnel officer told county retirees in a recent mailing (“Common Questions Regarding the United Health Care Medicare Advantage PPO Plan”) that “UnitedHealthcare is unable to provide a document which shows all the procedures which require prior authorization.” However, UnitedHealthcare’s Evidence of Coverage Document for 2024 (Exhibit “3”), which was only provided to plaintiffs’ counsel on Oct. 16, 2023, provides a long, although possibly incomplete, list of procedures, tests and medications subject to prior authorization.

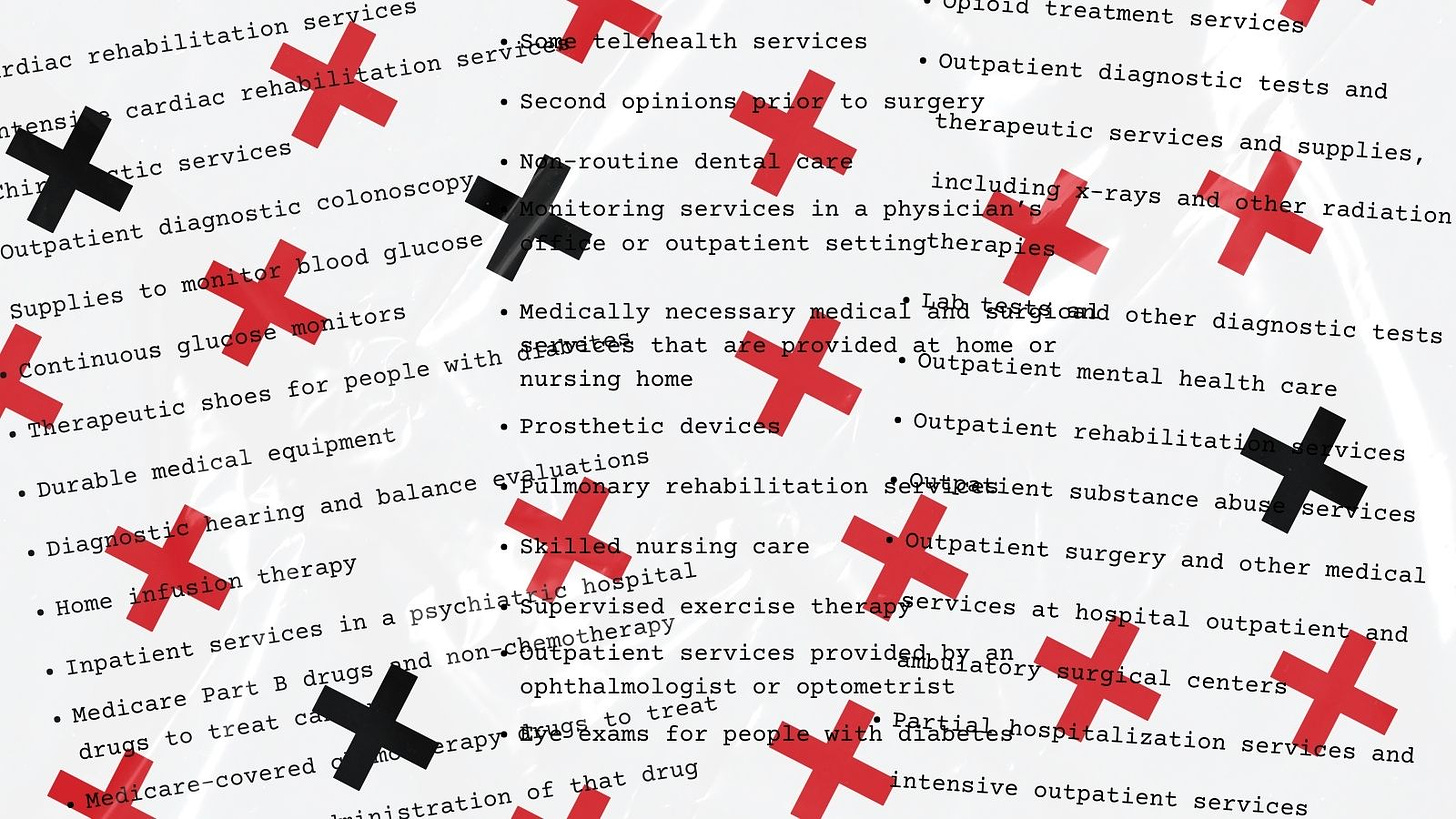

The list includes:

Cardiac rehabilitation services

Intensive cardiac rehabilitation services

Chiropractic services

Outpatient diagnostic colonoscopy

Supplies to monitor blood glucose

Continuous glucose monitors

Therapeutic shoes for people with diabetes

Durable medical equipment

Diagnostic hearing and balance evaluations

Home infusion therapy

Inpatient services in a psychiatric hospital

Medicare Part B drugs and non-chemotherapy drugs to treat cancer

Medicare-covered chemotherapy drugs to treat cancer and the administration of that drug

Opioid treatment services

Outpatient diagnostic tests and therapeutic services and supplies, including x-rays and other radiation therapies

Lab tests and other diagnostic tests

Outpatient mental health care

Outpatient rehabilitation services

Outpatient substance abuse services

Outpatient surgery and other medical services at hospital outpatient and ambulatory surgical centers

Partial hospitalization services and intensive outpatient services

Basic hearing and balance exams

Some telehealth services

Second opinions prior to surgery

Non-routine dental care

Monitoring services in a physician’s office or outpatient setting

Medically necessary medical and surgical services that are provided at home or nursing home

Prosthetic devices

Pulmonary rehabilitation services

Skilled nursing care

Supervised exercise therapy

Outpatient services provided by an ophthalmologist or optometrist

Eye exams for people with diabetes

If there was ever a good example of how insurers “make it nearly impossible to understand — or even to obtain — information we need,” this is one.

As I noted earlier, members of Congress are finally waking up to how insurers are taking advantage of taxpayers as well as seniors and disabled people who rely on Medicare to get the care they need. A few weeks ago, Reps. Ritchie Torres (D-NY) and Nicole Malliotakis (R-NY) introduced The Right to Medicare Act, a bipartisan bill that would prohibit a public or private employer from involuntarily forcing seniors from their traditional Medicare plan to Medicare Advantage plans without a choice. It would instead require employers to offer seniors an opt-in option to be shifted over to Medicare Advantage. It would also put Congress on the record as affirming that all U.S. seniors have a right to choose for themselves between traditional Medicare and Medicare Advantage.

Subscribe to HEALTH CARE un-covered

Pulling back the curtains on how Big Health is hurting Americans and how we got to this point.

The retired employees in the Ithaca City School District raised money to hire an attorney to persuade the school district to move us off of the forced Aetna Medicare Advantage insurance and give us the option we were using earlier, Medicare with a gap policy of Hartford Mutual.

Good! However, this is not a sustainable action. Congress needs to act now. MA overbills the government, i.e., your tax dollars by billions. Do a search. Easy to find stats.