Discover more from HEALTH CARE un-covered

Elevance Health is denying care for Medicaid patients at high rates, according to Department of Health and Human Services report

As I wrote a few days ago, Elevance, the big for-profit health insurer previously known as Anthem, reported making $5.5 billion in profits in just the first six months of this year, a 14.4% jump from the $4.8 billion in profits it made during the same period of 2022.

As I noted, a growing percentage of Elevance’s profits are coming from taxpayers. That’s because most of the company’s health plan enrollment gains over the past few years have come from the Medicare Advantage plans it operates and, especially, from the Medicaid plans it manages for several states.

What I hadn’t yet seen when I wrote that story was a major report by the Department of Health and Human Services Office of Inspector General (OIG) that helps explain how Elevance was able to make so much money on the 11.8 million low-income Medicaid beneficiaries it says it serves. In many cases, according to the OIG, Elevance is not approving coverage for medical care doctors say their Medicaid patients need.

Elevance and Medicaid

Elevance is a very big player in Medicaid. More than one of every seven Medicaid beneficiaries in the United States is now enrolled in a plan managed by the company, which encompasses several for-profit Blue Cross Blue Shield plans.

Managed care organizations like Elevance that manage states’ Medicaid programs are paid a set amount for each Medicaid beneficiary rather than on a fee-for-service basis, which means that the less Elevance spends paying claims, the more it can pocket and share with its investors.

One way big insurers avoid paying claims in both their Medicare Advantage and Medicaid businesses is by refusing to cover treatments and medications patients’ doctors say are necessary. It has become such a big issue in the Medicare Advantage program that Congress is calling on the Biden administration to do something about it. In late June, Sen. Sherrod Brown (D-Ohio) led a joint letter signed by 300 of his fellow lawmakers in both the House and Senate asking the Center for Medicare & Medicaid Services to fix the prior authorization process in Medicare Advantage.

As bad as the problem is in Medicare Advantage, federal investigators say it is considerably worse in Medicaid.

Elevance stands out in OIG Report

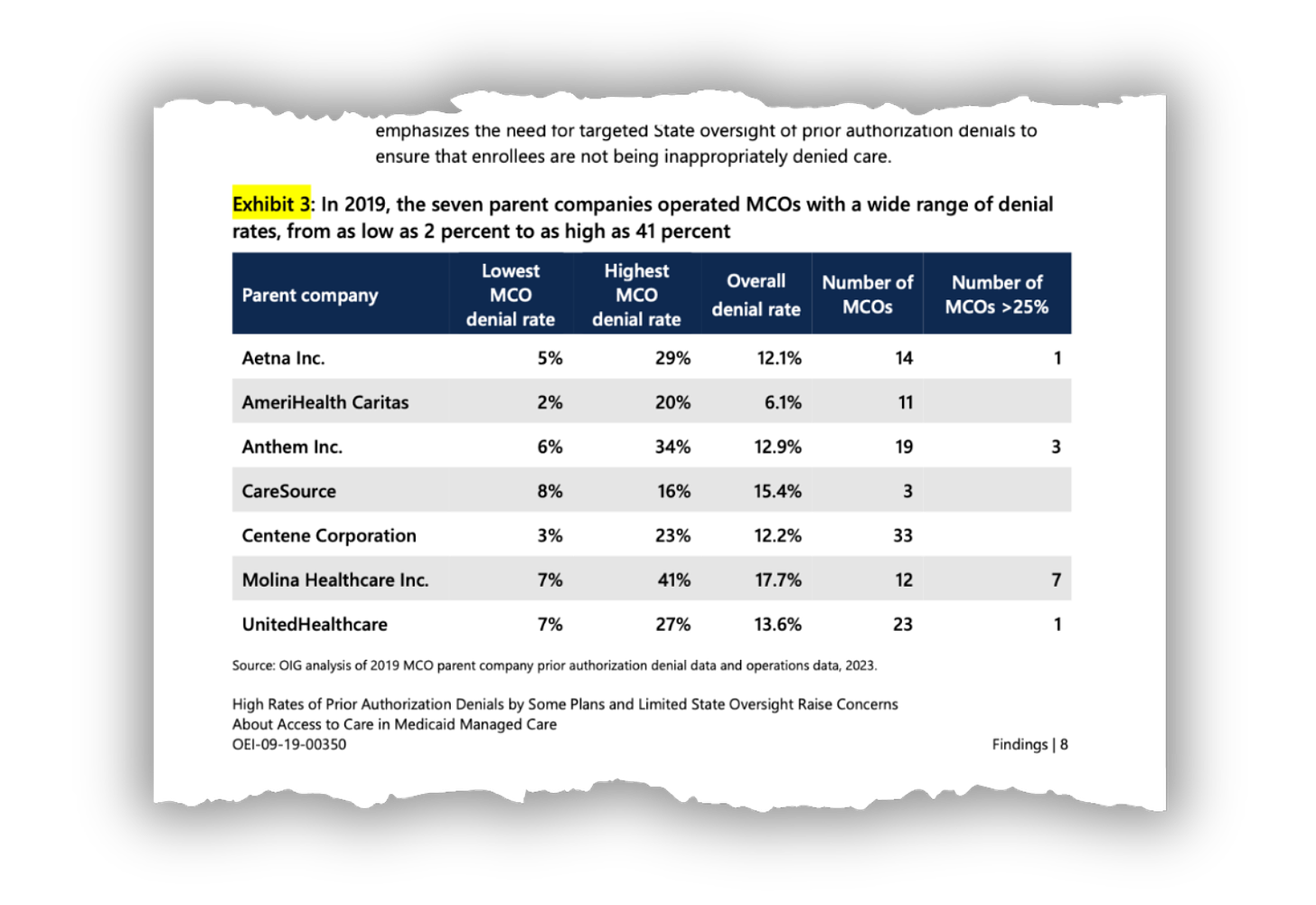

According to the OIG, which looked at Medicaid data from 2019, insurers denied one of every eight requests overall–twice the rate in the Medicare Advantage program. Perhaps not surprisingly, Elevance had one of the highest denial rates among the 115 managed care organizations the OIG included in its study.

As the OIG reported, of those 115 Medicaid MCOs, 12 had prior authorization denial rates greater than 25%–twice the overall rate.

And among those 115, Elevance really stood out–by denying more than one of every three requests (34%) for coverage in one or more of the company’s Medicaid health plans. Only Molina Healthcare, a smaller competitor, denied more in some states than Elevance (up to 41%).

As the New York Times noted in a July 19 story, the OIG report “details how often private insurance plans refused to approve treatment and how states handled the denials,” which, as it turns out, is not very well.

The Times reported that OIG investigators “also raised concerns about the payment structure that provides lump sums per patient. They worried it would encourage some insurers to maximize their profits by denying medical care and access to services for the poor.”

Those concerns appear real when you look at Exhibit 3 in the OIG report, which shows the denial rates of seven MCOs. Two of those seven–AmeriHealth Caritas and CareSource–are nonprofits. The other five are for-profit companies that collectively control access to care for more than a third of all Medicaid beneficiaries in the country.

The two nonprofits had by far the lowest denial rates. At AmeriHealth Caritas, one or more of the company’s plans had denial rates as low as 2%.

The OIG called on the states and the federal Center for Medicare & Medicaid Services to ramp up its scrutiny of private insurers like Elevance that are getting ever-increasing percentages of their overall profits from taxpayers. The investigators said that most state Medicaid agencies do not review the appropriateness of MCO prior authorization denials on a routine basis and that many states didn’t even collect or monitor denial data.

State officials must also take action

This should be advice lawmakers and regulators in Ohio and Virginia in particular should heed. Elevance has a big market share in both states and is in an ongoing contract dispute with Bon Secours Mercy Health, a big hospital system that operates in both states. BSMH says Elevance owes it $100 million in late and unpaid claims.

On July 1, Elevance kicked Bon Secours out of its hospital network in Ohio when the two companies could not agree on a new contract. That means low-income Medicaid patients in the state who are treated at one of BSMH’s 23 hospitals in Ohio–from Cincinnati in the south to Toledo and Youngstown in the north–could face potentially high out-of-pocket costs.

To avoid those costs, BSMH’s Medicaid patients in Ohio likely will have to travel to another hospital that’s still in the insurer’s network. Medicaid patients in Virginia could be in the same predicament if the two sides don’t reach an agreement there by October 1.

Subscribe to HEALTH CARE un-covered

Pulling back the curtains on how Big Health is hurting Americans and how we got to this point.

Caresource of Ohio (Medicaid) did the exact same thing to our laboratory with impunity. They systematically denied hemoglobin A1C and lipid panel testing FOR ANY FREQUENCY, even new patients not previously seen, for diabetic and prediabetic patients. I reported this to Ohio Department of Medicaid and they sat on it for some reason. They didn't disagree with our assessment, just appeared to be helpless.