Discover more from HEALTH CARE un-covered

Anthem, the USA’s second biggest insurer, has had spectacular growth over the past 10 years.

And they have you and your fellow taxpayers to thank.

Anthem, the for-profit insurer that owns and operates many of the country’s Blue Cross and Blue Shield companies, has grown almost exclusively at taxpayers expense since the Affordable Care Act was passed in 2010.

When Anthem announced second quarter profits this week, it reported covering 44.3 million Americans in its various health plans as of June 30, 2021. That’s an increase of slightly more than 10 million since June 30, 2011 when the company’s total membership stood at 34.2 million.

But here’s the thing: all but 712,000 of that 10 million gain came from its government business, and primarily from extraordinary growth in the state Medicaid programs it manages. (As a result of intense industry lobbying over many years, most states now contract with private insurers to operate their Medicaid programs.)

On June 30, 2011, Anthem – then called WellPoint – had a little more than 1.8 million people enrolled in its Medicaid business. Ten years later, that number has ballooned to nearly 9.8 million.

Anthem’s good fortune is just the latest evidence of how spectacularly well for-profit insurers have benefited from the Affordable Care Act of 2010, which made many more low-income Americans eligible for Medicaid. Most of the Americans who now have health insurance as a result of the ACA have it not because of the so-called Obamacare exchanges the law established but because of the Medicaid expansion. Anthem’s Medicaid enrollment increased a whopping 19% over the past year alone.

The other big taxpayer-financed program Anthem is profiting from is the Medicare Advantage program. Medicare Advantage plans are the privately owned and operated alternative to the traditional Medicare program. Along with Medicaid, Medicare Advantage plans have become one of the insurance industry’s biggest cash cows. Enrollment in Anthem’s Medicare Advantage plans has doubled over the past 10 years, from slightly less than 1.4 million to nearly 2.8 million.

A significant chunk of Anthem’s growth in its government business came as a result of its acquisition of a smaller competitor’s Medicaid and Medicare Advantage operations in Puerto Rico.

Anthem is not alone in growing almost exclusively at the expense of Uncle Sam. UnitedHealth Group, which reported second quarter earnings earlier this month, and the other big for-profit insurers have seen either declines or modest growth in business from private-paying customers, including from employers that offer subsidized coverage to their workers.

Anthem reported taking in nearly $34 billion in revenues during the second quarter of this year, up 16% from the $29.3 billion it reported for the same period last year. During the first six months of the year, it has taken in $66.2 billion in revenues, an increase of 12.5% over the first half of 2020.

Here’s another way of looking at how Anthem has benefited from the ACA’s Medicaid expansion and the growth in its Medicare Advantage business: Ten years ago, Anthem took in twice as much in revenue from its private paying customers as it did from government programs. Now it is the exact opposite: Less than half of its revenues are coming from employers and individuals who have to buy coverage on their own because they are not eligible for either Medicaid or Medicare.

Despite anemic growth in Anthem’s employer-sponsored and individual health plans, that book of business (which it refers to as “commercial and specialty”) remains very profitable because of steady premium increases and big hikes in the deductibles, copayments and coinsurance its health plan enrollees have to pay out of their own pockets before their coverage kicks in.

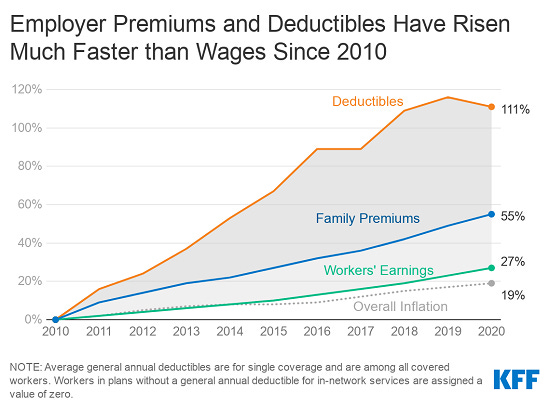

To put that into historical perspective, when the ACA was passed in 2010, the average cost of an employer-sponsored family plan was $13,770, according to the Kaiser Family Foundation. In 2020, it had increased 55%, to $21,342.

As steep as that increase was, it pales in comparison to the increase in deductibles, which skyrocketed 111% between 2010 and 2020. By comparison, workers’ wages have increased only 27% during those 10 years.

One of the reasons Anthem’s commercial business continues to be so profitable is because it doesn’t have to pay as many claims these days because its health plan enrollees have to pay far more for their health care out of their own pockets than in years past.

Instead of giving those health plan enrollees some relief from high deductibles and premium increases, Anthem instead spent $480 million during the second quarter of this year buying back its own shares of stock. Share repurchases are a tool big companies use to boost the unit price of their stock. It’s a gimmick that benefits a company’s top executives and investors, not its customers. Anthem said on Wednesday that it still has board approval to repurchase an additional $5.2 billion of its own shares in the coming months. Over the past 10 years, as premiums and deductibles have grown, Anthem has bought back tens of billions of dollars worth of its own shares.

Subscribe to HEALTH CARE un-covered

Pulling back the curtains on how Big Health is hurting Americans and how we got to this point.