Health insurers have spent nearly $141 billion buying back their own shares since 2007 while premiums and deductibles have skyrocketed

In 2007, executives of America’s biggest insurance companies were well on their way to transforming health insurance policies in ways that would make them and their companies’ shareholders vastly richer–while pushing millions of insured families deep into debt.

2007 was the year the industry-wide “consumerism” strategy–in which health plan enrollees would have to pay ever-increasing amounts out of their own pockets before their coverage would kick in–reached a point of no return.

It was also the year big insurers began using more and more of their customers’ premiums to buy back shares of their own stock, a gimmick, now common among investor-owned companies, that increases the value of each share.

It is a gimmick that has made a handful of industry executives billionaires at a time when 100 million Americans–the vast majority of whom have some form of health insurance–are mired in medical debt yet are still hit with premium increases every year. Largely because of share buybacks, insurers’ CEOs and other C-Suite executives have amassed vast fortunes as more and more of their compensation is paid in stock rather than cash.

In 2007, when I was still Cigna’s VP of corporate communications, Cigna used $1.158 billion of its customers’ premium dollars to buy back its own shares rather than to reduce premiums and out-of-pocket requirements. Fast forward 16 years. Both premiums and out-of-pockets are far higher than they were in 2007, enabling Cigna and other insurers to spend far more on share buybacks. Cigna alone spent $7.218 billion last year buying back its own shares, more than six times as much as it spent 16 years ago.

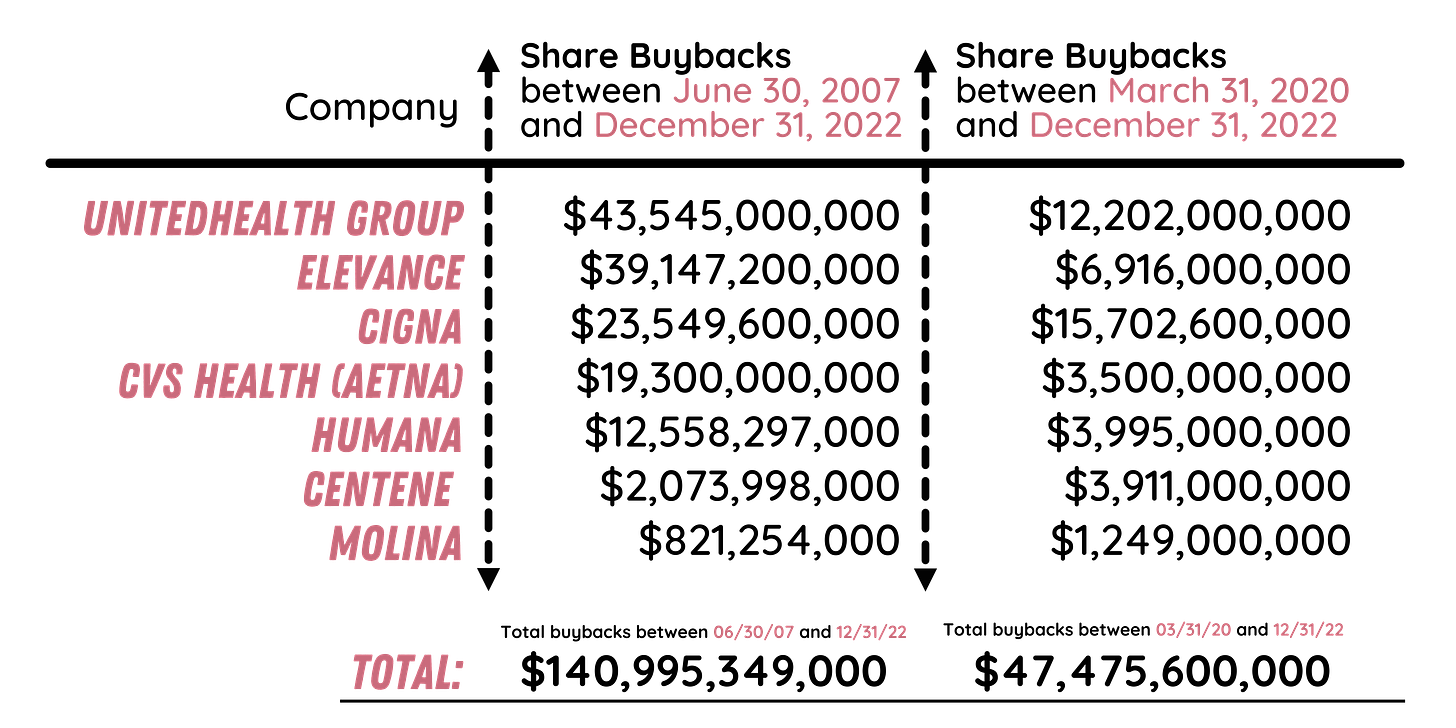

Combined, the big seven for-profit insurers have spent nearly $141 billion buying back their shares since 2007, according to YCharts, which tracks corporate stock buybacks, and the companies’ annual 10-K filings with the Securities and Exchange Commission. During that time, the cost of an average employer-sponsored family health insurance policy has increased 86%, from $12,090 to $22,463. The portion of the total premium paid by employees has increased even more dramatically during those 15 years–from $1,745 in 2007 to $6,106. And out-of-pocket requirements have skyrocketed. The average deductible for a single coverage plan, for example, nearly doubled between 2010 and 2021.

As much as I regret it, I was among the cheerleaders for high-deductible plans during much of my career in the insurance industry. My team and I put together talking points and white papers claiming that insured Americans needed to put more “skin in the game” by paying more out of their own pockets for medical care, a requirement that was the central and most important element of the industry’s “consumerism” strategy.

In our talking points and white papers, we assured policymakers and employers that under “consumerism,” American health care “consumers” would have far more information available to them to make prudent, cost-effective choices. That, we promised, would bring down both the cost of care and health insurance premiums. We now have nearly two decades of evidence that those were empty promises. Not only have premiums and the unit costs of health care goods and services increased without interruption, but out-of-pocket requirements have also risen so high that millions of Americans are walking away from the pharmacy counter without their medications. (The annual out-of-pocket maximum allowed by the Affordable Care Out goes up every year and now stands at $18,200 for a family policy, far more money than most families have in the bank.) Meanwhile, millions of insured patients who need medications to stay alive or who could not avoid a stay in the hospital have sunk deep into debt, as Kaiser Health News has reported.

Now I understand that our “skin in the game” campaign and strategy was nothing more than a ruse to enable big insurers to avoid paying millions of their customers’ claims every year and to convert more of their customers’ premium dollars into profits. In addition, the strategy meant that billions of dollars insurers previously spent on claims would become available for share buybacks.

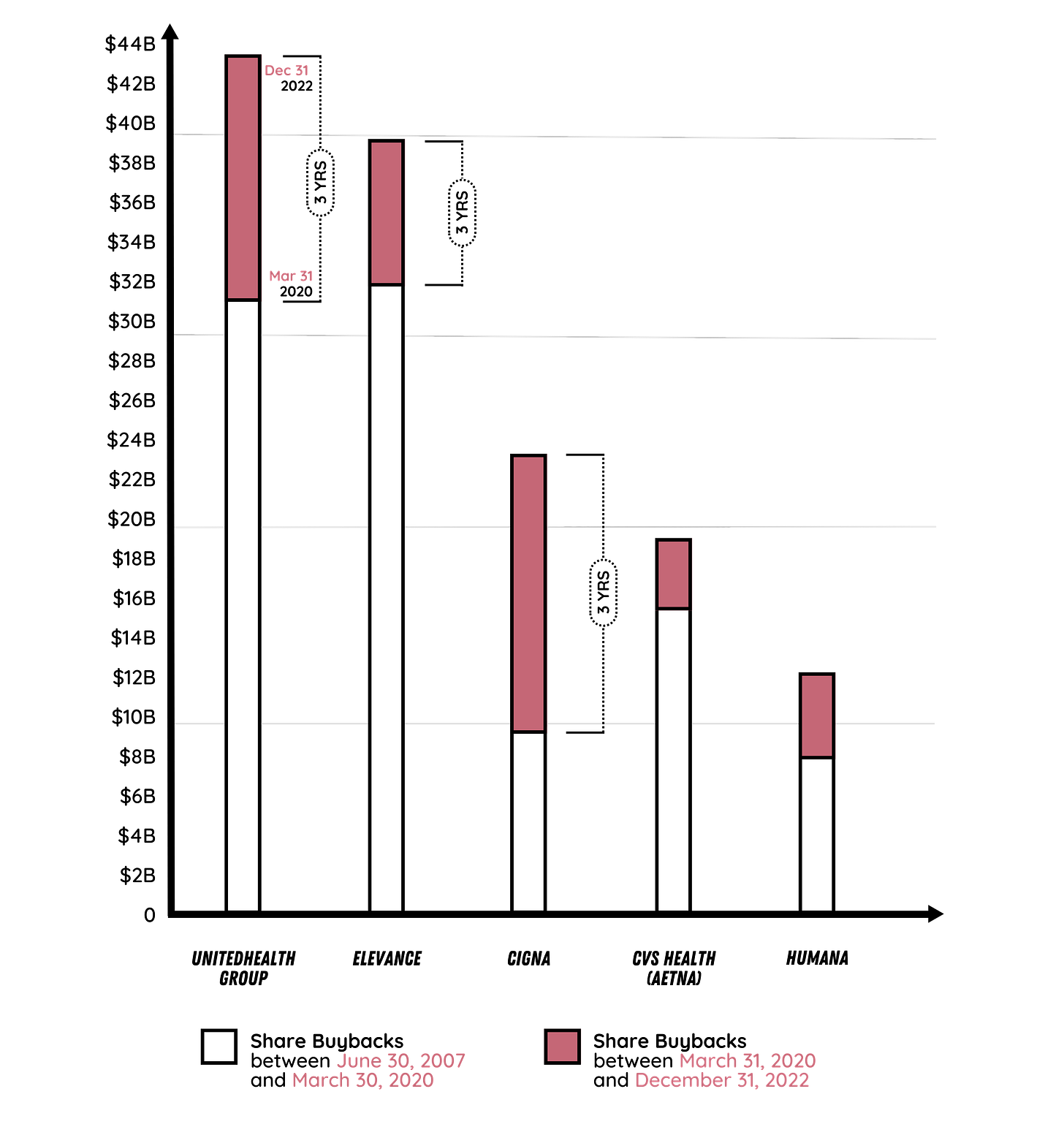

3 BUSY YEARS: Between the start of the COVID-19 Pandemic in March 2020 and New Years 2023, five of the seven publicly-traded health insurers spent more than $42 billion buying back their own shares of stock

It is important to note that while health insurers have been buying back shares for several years, some of them increased their buybacks significantly during the pandemic. Of the $23.5 billion Cigna has spent buying back shares since June 2007, for example, 67%–$15.7 billion–has been spent on share repurchases since March 2020.

By far the biggest spender on share repurchases has been UnitedHealth Group, which has used $43.5 billion of its customers’ money buying back shares since June 2007. The company spent more than 28% of that total ($12.2 billion) buying back shares between March 2020 and December 2022.

It is also important to note that share buybacks were considered stock manipulation prior to 1982. That year, President Ronald Reagan’s SEC implemented a rule change that paved the way for massive buybacks in subsequent years.

Bills have been introduced in both the House and Senate to rein in buybacks, but none have gotten through Congress yet. Several House members joined Reps. Peter DeFazio of Oregon and Ro Khanna of California last October as cosponsors of the Reward Work Act, which would repeal the Reagan-era SEC rule.

As former Rep. DeFazio said in a press release when the bill was introduced:

Corporate greed is at the heart of stock buyback initiatives, which place corporate executives and wealthy shareholders ahead of American workers and families. It is unconscionable that companies continue to rake in billions in record-breaking profits through tax breaks and buybacks while hardworking Americans struggle or are laid off. Our legislation would right this wrong and once again ban corporations from engaging in stock buybacks and manipulating the market – finally correcting the Reagan Administration’s absurd decision to allow corporations to engage in this practice.”

On the Senate side of the Capitol, Senate Majority Leader Chuck Schumer of New York and Sen. Bernie Sanders of Vermont introduced legislation in 2019 to limit corporate share buybacks. They made the case for their bill in an op-ed in the New York Times.

Meanwhile, the money that health insurers use to buy back their shares is increasingly coming from us as taxpayers, not just as private-paying customers. That’s because most of the big seven insurers have focused their marketing efforts in recent years on attracting seniors into their highly profitable Medicare Advantage plans. In addition, several of the insurers make billions of dollars in profits managing state Medicaid programs.

Proponents of the status quo contend that Americans who own shares of stock in various companies benefit from share buybacks, but the truth is that most of the insurers’ shares are owned not by individuals but by huge institutional investors–and, of course, by the insurers’ top executives, who have become some of America’s richest people, especially since the start of the pandemic.

Editor’s note: The numbers cited in this analysis are from YCharts and the companies’ SEC filings. We used Aetna’s annual 10-K filings prior to its 2018 acquisition by CVS as the data sources because YCharts does not provide pre-acquisition totals for Aetna. Note also that the March 2020-December 2022 totals for Centene and Molina are higher than the totals between June 2007 and December 2022. That’s because both companies sold more shares than they bought during some years prior to the start of the pandemic.

On February 2, 2022 a Senate Finance Subcommittee Chaired by Sen E. Warren was held to discuss the Future of Medicare. I suggest that everyone SPEND TWO HOURS AND LISTEN AND TAKE NOTES - BE INFORMED. This should be a required homework assignment. The MEDICARE PROGRAM is being looted via multiple methods of fraud, trade restraints, anti-competing strategies, and purchased politicians. Nancy Pelosi received an award from her hospital friends for her work on preventing changes to their looting. Joe Biden just gave United Health Group a $900 million boost of income by delaying implementation of ant-fraud measures from CMS.

The greed, looting and pillaging of the American people has to stop. Thank you for continuing to highlight the dynamics here. Fundamentally, this is a problem of greed, but we can never erase greed from humanity so the only option is to remove the perverse incentives that have been built into every aspect of our economic structure for the past 40-50 years. Obviously increasing competition is one aspect of this as well but as you say, that SEC rule change on stock buybacks, the removal of any caps on consumer interest rates, tying C-suite pay to share price rather than real world performance are all part of this perverse incentive environment. When the politicians in DC gutted the Congressional Research Service and all the very effective regulatory bodies the field was left open to shysters and lobbyists to paint a portrait of reality that is utterly self-serving and delusional, and since our legislators are essentially paid by these same self-interested actors, the whole thing is as corrupt as possible. And here we are with an almost entirely monopoly economy in every important sector and our country can no longer compete. Great job America.