Discover more from HEALTH CARE un-covered

A decade-long look at how Big Insurance profiteers American taxpayers and the sick.

Anthem, Centene, Cigna, CVS/Aetna, Humana, and UnitedHealth are bigger today than they were 12 years ago because of numerous mergers, acquisitions and a new love for tax dollars.

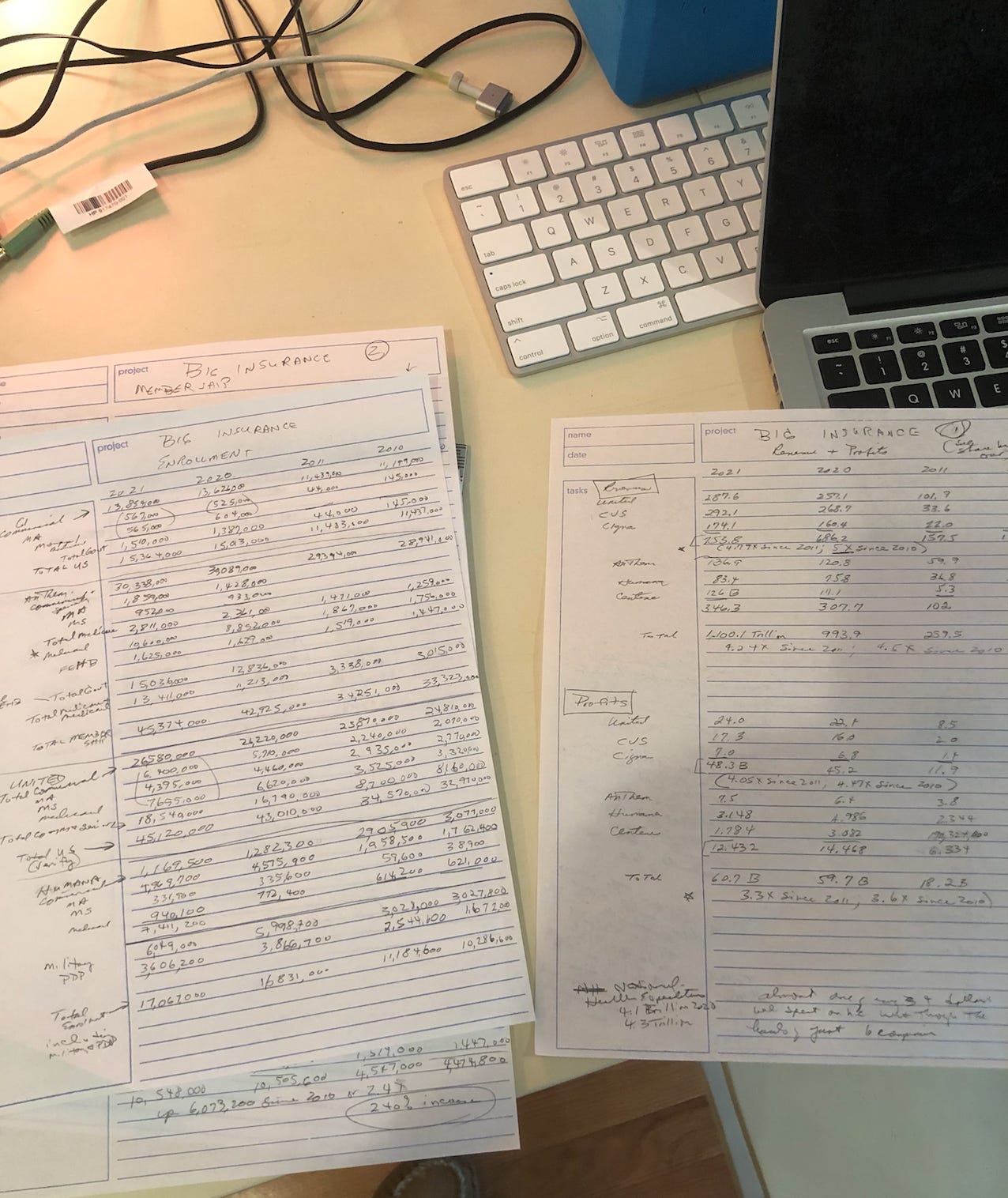

Over the past several days, I’ve been scouring a dozen years’ worth of big health insurers’ financial disclosures, and I’ve discovered some trends that go a long way toward explaining why most of us are paying much more for coverage that is far less useful and protective than it used to be.

I chose 12 years because I wanted to see how the six biggest for-profit insurers have fared since the Affordable Care Act was signed into law on March 23, 2010. A lot more of us have health insurance because of that law (although, infuriatingly, more and more of us are becoming “functionally uninsured,” as I’ll explain below), but it also set the stage for massive changes in the health insurance business.

Here’s what I found:

REVENUE AND PROFITS

Those six companies–Anthem, Centene, Cigna, CVS/Aetna, Humana, and UnitedHealth–are massively bigger today than they were 12 years ago as a result of numerous mergers and acquisitions and a new love interest: the government. In 2010, the companies took in a combined total of $245.2 billion dollars in revenue. Last year, that number had more than quadrupled to $1.1 trillion.

The three biggest–United, CVS/Aetna and Cigna–are five times bigger now than in 2010 in terms of revenue. Back then, their combined revenues totalled $149.5 billion. Last year: $753.8 billion. (Note: I used Aetna’s 2010 earnings report for this comparison. It merged with CVS at the end of 2017.)

Two of those companies–United and CVS/Aetna–have grown so fast they have leapfrogged into the top five of the Fortune 500 of America’s biggest companies. Only Walmart, Amazon and Apple took in more money last year than those two companies. (Cigna, the third largest in terms of revenue and my former employer, is now the 13th largest on the Fortune list.)

The big six insurers’ profits have soared along with their revenues. Last year they made $60.7 billion in profits collectively, compared to $16.9 billion in 2010.

Here’s another way of looking at this: In 2010, we as a nation spent $2.6 trillion (or $8,402 per person on average) on health care. That year, less than one of every ten dollars we spent flowed through those six companies. Last year, we Americans collectively spent $4.3 trillion on health care ($13,037 per person). Now, almost one of every four dollars we spend on health care flows through those six companies.

Relatively little of the six companies’ growth in health plan revenues and profits has come from private paying customers. By far most of the money they now collect to administer health plans comes from us as taxpayers. That’s because all of the companies have shifted their focus away from the private sector and toward various government-funded programs: Medicare, Medicaid, federal employees and the military.

HEALTH PLAN ENROLLMENT

In 2010, the six companies reported that 84.9 million people were enrolled in their commercial health plans (in which individuals and families and/or their employers pay the premiums). By last year, that number had grown just 7.6%, to 91.3 million. (Aetna and Humana, where I also used to work, actually served two million fewer people in their commercial plans in 2021 than in 2010.)

That slight overall increase in commercial health plan enrollment was overshadowed by the massive increase in enrollment in the Medicare and Medicaid plans operated by those six insurers. In 2010, 16.9 million Americans were enrolled in the Medicare Advantage, Medicare supplement and Medicaid plans operated by the big six. In 2021, that number had increased by 46 million–373%–to 63 million.

In addition, Anthem, Centene and Humana reported more than 10.5 million people last year were enrolled in the Federal Employees Health Benefits (FEHB) and military (Tricare) programs they administer, more than double the 4.5 million they reported in 2010.

Altogether, since 2010, nearly 90% of those six companies’ health plan enrollment growth has come from government-funded programs, which means that we as taxpayers are contributing to those companies’ good fortune, even if we are not enrolled in one of their plans.

Another not-so-fun fact: In 2010, slightly more than one of every three Americans were enrolled in a public or private plan administered by those six companies. Thanks to the many mergers and acquisitions since then, one of every two of us are now enrolled in one of their health plans. (And 31.1 million of us remain uninsured.)

HOW BIG INSURANCE PULLS THIS OFF

One way the companies have been able to boost their profits despite meager growth in their commercial health plans is by shifting more and more of the cost of care to insured patients. Kaiser Family Foundation researchers found that deductibles alone have increased more than 150% over the past decade.

And as Sara Collins of the Commonwealth Fund testified before Congress last week, one-fourth of adults in employer plans–and more than 40% of people enrolled in an ACA marketplace plan–are now underinsured because of ever-increasing deductibles and other out-of-pocket requirements.

The ACA did establish an out-of-pocket maximum for in-network care in a private insurance plan, but the maximum increases every year and is far higher than most Americans can afford. This year, the out-of-pocket maximum for a family is $17,400, up from $12,700 in 2014, the first year the ACA imposed a limit. And the maximum applies only to in-network care. Patients who go out of their health plans’ networks can be on the hook for far more before their coverage kicks in, and many plans provide no coverage for out-of-network care.

As Collins noted in her written testimony: “High out-of-pocket costs and deductibles can lead to delayed or avoided care and to medical debt when people do get care.”

U.S. health insurers also refuse to pay for billions of dollars worth of care requested by doctors through prior-authorization requirements and, as noted above, by providing little to no coverage for people who are treated by doctors and other providers outside of their health plans’ provider networks.

AND THEN THERE IS THIS

The Big Three of the Big Six make more money “managing” Americans’ prescription medications than by administering our health insurance plans. Aetna supersized itself when it merged with CVS, which operates the country’s largest pharmacy benefit management company, Caremark, in 2017. Cigna bulked up the next year when it merged with Express Scripts, the second largest PBM. And United’s fastest growing and most profitable division is Optum, which encompasses the country’s third largest PBM. Together, CVS, Cigna, and United control nearly 80% of the national PBM market. At all three companies, the PBMs now generate more profits than their health plan businesses.

Those three companies are also far bigger than the biggest company that actually makes prescription medications. Johnson & Johnson, the biggest U.S. drug company, ranks a distant 36 on the Fortune 500. To put that in perspective, J&J was #33 on the Fortune list in 2010. Cigna, which is now #13 was #129 in 2010.

PS: I bet this is the first time you’ve seen an analysis like this one, which pulls back the curtain on what Big Insurance has been pulling off while very few in the media and politics were paying attention. My name was on every one of Cigna’s financial reports for ten years, so I know how insurers obscure important information by using rosy language and hiding details in statistical supplements that accompany most earnings press releases. It just takes diligence to find those details and piece them together in a way that tells a revealing story.

I spent many hours reviewing those obscure stats, jotting them down and putting them in spreadsheets. The reason you don’t see anyone else doing this is because it’s tedious work, and you also have to know what you’re looking for. Let me know what you think. I’d love your feedback and any recommendations you might have for future analyses.

Subscribe to HEALTH CARE un-covered

Pulling back the curtains on how Big Health is hurting Americans and how we got to this point.

Very nicely done and sadly, all 100% extremely believable.

Another way the ACA was able to pull off the deception with voters was by demonizing professionals (physicians, nurses, therapists etc.) by telling everyone how they were all extremely overpaid. Physician payment was 9% of the entire healthcare spending pie back then- my guess is that it's dropped since then. No insurers have given any reimbursement raises except for Medicare.

Great work & unique perspective. Thank you for doing this.